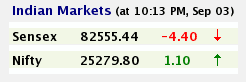

Sensex Now

Sensex Today 0/702/2020

Sensex Today 06/02/2020

Sensex Today 05/02/2020

Sensex Today 04/02/2020

Sensex Today 03/02/2020

Sensex Today 01/02/2020

Sensex Today 31/01/2020

Sensex Today /30/01/2020

Sensex Today 29/01/2020

Sensex Today 28/01/2020

Sensex Today 27/01/2020

Sensex Today 24/01/2020

Sensex Today 23/01/2020

Sensex Today 22/01/2020

Sensex Today 21/01/2020

Sensex Today 20/01/2020

Sensex Today 17/01/2020

Sensex Today 16/01/2020

Sensex Today 14/01/2020

Sensex Today 13/01/2020

- Sensex, Nifty Likely To Open Higher Today

- The Sensex index had ended 147.37 points higher at 41,599.72 on Friday, and the Nifty settled at 12,256.80, up 40.90 points from the previous close.

- Rupee opens stronger at 70.79/$ vs Friday's close of 70.93 against the US dollar

- Share Market LIVE: Sensex opens 180 points higher, Nifty at 12,296; Infosys up 2.5%

- MARKETS HIT RECORD HIGH

- The S&P BSE Sensex hit a fresh high of 41822.19, up 222 points

- The broader Nifty50, too, scaled peak of 12,325.45, up 68.65 points

- Infosys gains 3%in early trade post Q3 nos

- Avenue Supermarts trades higher as Q3 nos beat estimates

- L&T Finance Holdings rises 2%

- Edelweiss Financial Services gains 3% The company on Sunday said its group entities do not have any relationship with Capstone Forex, which is being probed by the Enforcement Directorate (ED) for an alleged multi-crore forex violation.

- HDFC Life Insurance trades 1% higher APE grew 35.3% YoY in December

- Lupin trades weak as US FDA classifies inspection of Tarapur facility as OAI

- US FDA has classified the unit as Official Action Indicated

- Says, The Company does not believe that this inspection classification will have on impact on disruption of supplies or the existing revenues from operations of this facility

- The facility was inspected between September 16 to September 20, 2019

Sensex Today 06/01/2020

- Sensex falls over 800 points, Nifty below 12,000 amid US-Iran tension

- Sensex fell 851 points intra day to 40,613. The index closed at 41,464 on Friday. Similarly, Nifty lost 252 points to 11,974 compared to the previous close of 12,226.

- SBI, Bajaj Finance and IndusInd Bank were the top Sensex losers. On Nifty, top losers were Zee Entertainment, SBI and Vedanta.

- On Friday, Sensex closed 162 points lower at 41,464 and Nifty fell 55 points to 12,226.

- Mid cap and small cap indices were trading 339 points and 271 points lower at 14,775 and 13,717 in afternoon session.

- Shares skidded in Asia with Tokyo's Nikkei 225 index down 2% on concern over escalating tensions in the Middle East following the death of a top Iranian general in a US air strike. In South Korea, the Kospi lost 1% to 2,154.24 and the S&P ASX 200 declined 0.3% to 6,716.20. Asian economies depend heavily on oil from the Middle East, and oil prices surged, with US crude up 2.4% and Brent crude up nearly 2.7% which led to fall in Asian markets. Stocks fell broadly on Wall Street on Friday, ended a five-week winning streak for the S&P 500 a day after the benchmark index hit its latest record high. Brent crude, used to price international oils, rose $1.85 or 2.7% to $70.45 per barrel. It gained $2.35, or 3.5%, to close at $68.60 per barrel on Friday.

- In early deals today, the rupee traded at 72.04 a dollar, down 0.3% from Friday's close of 71.81

- The Indian unit had opened at 71.99 and so far today has touched a low of 72.05 a dollar -- a level last seen on 14 November

- Sensex slumps over 700 points as crude advances on US-Iran tension

Sensex Today 01/01/2020

- Crude oil surged after a US airstrike killed a top Iranian general

- Oil marketing and paint companies fell as crude oil surged

- IIFL Securities gains 5%>> Billionaire investor Rakesh Jhunjhunwala's RARE Enterprises bought 27,84,879 shares of the company in a bulk deal on BSE.

- BUZZING STOCK:: Varroc Engineering surges 4%

- Shriram City Union Finance zooms 7%

- Gold prices surge today, jump ₹1700 per 10 gram in just two weeks

Sensex Today 26/12/2019

- Markets Live: Sensex falls 20 points, Nifty flat ahead of F&O expiry; DHFL, Reliance Infra gain 5% each.

- YES Bank, Vodafone Idea, JP Associates among most active stocks on NSE.

- CLOSING BELL: Sensex tanks 298 points, Nifty ends December F&O series at 12,127; IOB soars 20%, UCO Bank 11%

- Sensex tanks 298 points, Nifty ends December F&O series at 12,127; IOB soars 20%, UCO Bank 11%

Sensex Today 23/12/2019

Sensex struggles in early trade, RIL falls 2%.Indian markets struggled in early trade today amid some selling pressure in Reliance Industries or RIL shares. The Sensex was down 72 points at 41,609 while Nifty traded lower at 12,264. Titan Company, UltraTech Cement, Nestle India have been added to BSE Sensex from today whereas Tata Motors, Tata Motors DVR, Vedanta, and Yes Bank have been removed. Titan shares were up 2% in early trade.

For the Nifty, 12,200 is a very strong support and 12,350 a strong resistance, HDFC Securities said in a note.

RIL shares were down over 2%. Reliance Industries Ltd (RIL) on Sunday termed as “premature" the Union government’s attempt to enforce non-payment of $4.5 billion in an international arbitral award of the Panna-Mukta and Tapti (PMT) production-sharing contracts case.

On Friday, the Delhi High Court ordered RIL and BG Exploration and Production India Ltd (BG), a unit of Shell India, to disclose their assets after the Centre sought to restrain the companies from disposing the assets.

"Going ahead, Union budget is likely to be crucial for the market on account of new steps to attract investments. Considering strong liquidity, the momentum is likely to shift from pricey stocks to value stocks going ahead. We believe that this is a good time to invest in cyclical stocks and sectors like metals, energy, capital goods and industrials. However, a short-term consolidation cannot be ruled out as investors may slid to a holiday mood," said Vinod Nair, Head of Research at Geojit Financial Services.

Asian markets were mixed today with activity thinning out as investors wind down for the Christmas break, while confidence remains buoyed by relief at the China-US trade deal.

Global equities are enjoying a flourish at the end of the year, having been on a roller-coaster ride for 12 months owing to the long-running trade row and Brexit.

Sensex Today 20/12/2019

The benchmark S&P BSE Sensex closed at 41,681.54-level, up 7.62 points or 0.018 per cent. Tata Steel, YES Bank, SBI, and Hero MotoCorp were the top gainers at the 30-share index, while Vedanta, Tata Motors, ITC, and M&M were the top drags for the day. On the NSE, the broader Nifty50 settled little changed at 12,271.8-mark, up 12.1 points or 0.09 per cent. Markets ended at record closing highs for the fourth straight session.

The benchmark Sensex and Nifty hit fresh highs of 41,809.96 and 12,293.90, respectively.

In a major corporate development, Mahindra & Mahindra (M&M) on Friday announced a rejig of its top management with Anand Mahindra, 64, transiting to the role of non-executive chairman from executive chairman, effective 1 April, 2020. In a statement, the firm said Pawan Kumar Goenka has been re-appointed the managing director with additional responsibilities of chief executive officer (CEO) for a year, effective 1 April, 2020. Shares of Mahindra and Mahindra reversed their 0.7 per cent intra-day gain, and declined 1.2 per cent in the intra-day deals today. The counter eventually settled 0.86 per cent lower at Rs 530.45.

Sensex Today 19/12/2019

Indian stock markets on Thursday pared losses and hit a fresh record high led by gains in auto and banking stocks. Volumes were low as traders avoided taking large positions amid lack of fresh cues with year-end holidays around the corner.

At 12pm, benchmark Sensex was 0.19% higher or 77.18 points to 41635.75 points, while Nifty was up 0.21% or 25.60 points to 12247.25.

Investors will await Reserve Bank of India's minutes of monetary policy committee meeting due later today. For today, analysts expect mixed trend on the sectoral front after the broader indices ended slightly lower on Wednesday.

Auto stocks gained after Federation of Automobile Dealers Associations, a representative group of automobile dealers, on Wednesday, approached the Supreme Court to allow automobile dealers to sell and register vehicles compliant with Bharat Stage 4 emission norms after April 2020. Hero MotoCorp, Mahindra & Mahindra, Tata Motors, Maruti Suzuki India and Bajaj Auto rose 0.2-2.4%.

Among banking stocks, HDFC Bank Ltd, State Bank of India, Axis Bank, Federal Bank, Kotak Mahindra Bank climbed 0.2-0.7%.

Tata group companies were trading mixed. The National Company Law Appellate Tribunal on Wednesday reinstated Cyrus Mistry as chairman of Tata Sons and held as illegal the appointment of N. Chandrasekaran as his successor, triggering a new spell of uncertainty for India’s largest conglomerate. Tata Consultancy Services rose 0.9%, Titan was flat, Tata Steel fell 0.5%, Voltas was up 0.6%, Tata Global Beverages 0.7%, and Tata Chemicals rose 0.2%.

Meanwhile, GST Council, in its 38th meeting on Wednesday, voted for uniform rate of 28% on lotteries across the country. Despite pressure to boost revenues amid a shortfall, the GST Council chose not to tamper with the rates. It was decided to extend the annual date of GSTR 9 filing to January 31, 2020 and waive late fee for all taxpayers who have not filed GSTR1 from July 2017 to November 2019.

In US, Dow Jones fell 0.1% while S&P500 ended flat. In Asia, Nikkei and Hang Seng were down 0.5% each as investor optimism about an interim US-China trade deal announced last week were tempered by fresh worries over a hard Brexit.

Sensex Today 18/12/2019

sensex today: Sensex, Nifty soar to fresh lifetime highs; Tata Motors drops over 3%

Equity benchmarks sensex and Nifty surged to fresh highs on Wednesday, tracking gains in index heavyweights HDFC Bank, RIL and ITC amid unabated foreign fund inflows. After rallying to its record intra-day peak of 41,614.77, the 30-share BSE sensex settled 206.40 points, or 0.50 per cent, higher at its all-time closing high of 41,558.57.

Similarly, the broader NSE Nifty advanced 56.65 points, or 0.47 per cent, to its record closing high of 12,221.65.

M&M was the top gainer in the sensex pack, surging 3.37 per cent, followed by Sun Pharma 2.53 per cent, Asian Paints 1.88 per cent, ITC 1.66 per cent, HDFC Bank 1.58 per cent and Tech Mahindra 1.51 per cent.

On the other hand, Tata Motors plunged 3.05 per cent after the National Company Law Appellate Tribunal (NCLAT) on Wednesday ordered restoration of Cyrus Mistry as the executive chairman of Tata Sons. NCLAT also held appointment of N Chandrasekaran as executive chairman illegal.

Other Tata group stocks including Tata Power, Tata Chemicals and Tata Global Beverages too fell up to 4.14 per cent.

HUL, SBI and Yes Bank fell 1.79 per cent each. NTPC, PowerGrid and Bajaj Finance also ended in the red.

Besides stock-specific action, sustained foreign fund inflows boosted market mood here, traders said.

On a net basis, foreign institutional investors bought equities worth Rs 728.13 crore, while domestic institutional investors sold shares worth Rs 796.38 crore on Tuesday, data available with stock exchange showed.

Bourses in Shanghai, Hong Kong, Seoul and Tokyo ended on a mixed note, while those in Europe saw tepid trading sentiment.

On the currency front, the rupee depreciated 6 paise against the US dollar to 71.05 (intra-day).

Brent futures, the global oil benchmark, was fell 0.76 per cent to $65.58 per barrel.

Disclaimer: The views and investment tips expressed by investment experts on sharemarketgo.in are their own, and not that of the website or its management. sharemarketgo.in advises users to check with certified experts before taking any investment decisions.

إرسال تعليق