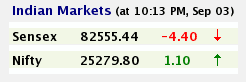

Live Sensex Today Latest Updates

Sensex Today 30/01/2020 Today Sensex News,Nifty 50 Live,And Bank Nifty Live ,Today Market News Live Updates On ShareMarketGo.

Sensex Today 30/01/2020

- SGX NIFTY LIVE

- At 7:35 AM SGX NIFTY 12123 ( -9.50 Point Up)

- Cnbc Awaaz Live Tv Moneycontrol

- Aurobindo Pharma plunges 8% as USFDA classifies oral solids plant as OAI

- Emami Ltd slides 5%

- Avenue Super-marts hits fresh all-time high, gains 5% in two days

- Macquarie downgrades RIL to 'underperform'; says will buy around Rs 1,200

- The S&P BSE Sensex dipped 255 points, or 0.6 per cent, to 40,930 levels. Reliance Industries, Tata Steel, and IndusInd Bank (all down 1%) were the top laggards in the Sensex pack. On the other hand, NTPC gained 1 per cent.

- The broader Nifty50 index dipped 76 points, or 0.64 per cent, to Rs 12,050 levels.

- All the Nifty sectoral indices were trading in the red. Nifty Pharma index, down 1.4 per cent, bled the most, while Nifty Private Bank and Nifty PSU Bank indexes, were both down 0.8 per cent.

- Market Live: Indices extend losses, Nifty below 12,050; Yes Bank down 5%

- Sarda mines case: Supreme Court allowed JSPL to lift Rs 2,000 crore of iron ore from Sarda only after repayment of penalty dues by Sarda.

- Axis Bank to allot debentures worth Rs 4175 cr: The bank approved the allotment of 41,750 Senior Unsecured Redeemable Non-Convertible Debentures of the face value of Rs 10 lakh each (Debentures), for cash, at par aggregating to Rs 4,175 crore at coupon rate of 7.65% p.a on a private placement basis. The said Debentures is rated "AAA/Stable" by CRISIL and "AAA/Stable" by ICRA.

- Rupee at day's low: The Indian rupee extended its morning losses and trading at day's low level at 71.45 per dollar versus Wednesday's close 71.25.

- Jubilant FoodWorks gains 2% post Q3 results: The company's standalone profit grew 7.5 percent year-on-year at Rs 103.7 crore from Rs 96.5 crore in the same period last year. Meanwhile, standalone revenue from operations grew 14.1 percent YoY to Rs 1,059.6 crore.

- Share price of Escorts jumped 5 percent after the tractor-maker reported a 9.27 percent increase in net profit at Rs 153.1 crore for the third quarter ended December 31, 2019. The company had reported a net profit of Rs 140.1 crore for the same period the previous financial year. Research firm HSBC has initiated a buy rating on the stock and has raised the target to Rs 900 from Rs 830 per share. It is of the view that a strong margin recovery in Q3 should allay street concerns and improving growth and margin outlook should drive upgrades to estimates.

Post a Comment